The Dow Jones FXCM Dollar Index continued to rise over the past 24 hours on surfacing news that the government was coming closer to making a deal to push off the pending debt ceiling.

In yesterday’s NY session, the US Dollar rallied temporarily as the FOMC minutes from the September meeting announced that the decision to not start taper was a close call.

However, as the market gave the minutes closer analysis, it decided that they didn’t add anything new to the taper conversation and the greenback retraced all of the earlier gains in the major pairs making up the index.

Overnight, the US Dollar rallied to a new weekly high. It’s possible that the move higher was a reaction to rumors of a later-confirmed story that the House republicans were getting ready to support a bill to push off the debt ceiling. However, most of those gains were unwound through the rest of the Tokyo and London sessions, despite the confirmation of the rumor as NY traders came online.

Written by Benjamin Spier, DailyFX

Translate

Thursday, October 10, 2013

Friday, September 27, 2013

EUR/USD tug-of-war ahead of central banks while awaiting DC to take a decision

Special winds of recovery in the Eurozone have fueled the Euro in the last days, but its indecision is latent as investors are waiting for Washington developments on debt ceiling and next week big events. Despite all the noise of these days, the EUR/USD closed a 5-pip negative Doji candle in the week.

The biggest topic this week was the lack of agreement in debt ceiling. It seems lawmakers will wait until the 11th hour in Monday, but the problem is that it matches with the end of the month and quarter. Many investors, traders and portfolio managers are worrying on it as the Dow and the S&P 500 closed its sixth negative session of the last seven.

The uncertainty is the topic in the currency markets too, as investors prefer more hints in the Washington battle and, despite recent good economic data, about the possibility of further easing by the ECB. "In his recent speeches, Draghi has been teasing the markets with hints of further easing," comments the BabyPips.com FX-Men Team. "This is a bit surprising, considering the euro zone has recently shown notable improvements in consumer confidence and overall economic activity."

Answering this topic, BabyPips affirms that "the central bank is probably just trying to maximize their current easing programs by keeping a lid on longer-term rates." In this line, FXstreet.com's analyst Katarzyna Komorowska shares in her ECB and BoE previous that her sources "expect the European Central Bank to maintain monetary policy unchanged at the next meeting.”

In this framework, the EUR/USD's buying interest is losing momentum according to the Forecast Poll as experts expect more gains the next week. However, market players expect Euro to Dollar exchange rate to lose ground in the long term.

In the short term, FXstreet.com Chief Analyst comments that "the bearish case looks worse ahead of a new month start: next week, the ECB economic policy meeting and the US employment data, will surely provide more reasons to buy the pair than to sell it." As for technical levels, "failure to overcome 1.3570 and steady losses below mentioned 1.3460 should put the pair in downside corrective mode, eyeing then 1.3280 area, where the pair will finally fill the weekly opening gap from September 15th," concludes Bednarik.

The GBP/USD advanced on Friday and it closed above the 1.6100 area for first time since the Fed's non-taper day. It was the fourth week of gains in a row as the GBP/USD has won around 700 pips in a month and 1300 pips since July 6 when the pair posted its double bottom.

The USD/JPY lost all its Thursday’s gains on Friday as the pair declined from 99.00 to close at 98.25. The AUD/USD tested the 0.9300 area today after extending declines from September 19th highs at 0.9520.

Main headlines in the American session

August US Personal spending 0.3% vs 0.3% exp m/m

US: PCE rose 1.2% YoY in August

US: Reuters/Michigan Consumer Sentiment Index slides to 77.5 in September

Austria keeps the AAA rating, outlook stable

Dudley: Time between end of QE and first rate hike ‘could easily be a number of years’

CFTC Commitments of Traders: Traders dump bets on the dollar after the Fed

Wall Street declines on Friday and closes its first negative week in four

(Fxstreet)

The biggest topic this week was the lack of agreement in debt ceiling. It seems lawmakers will wait until the 11th hour in Monday, but the problem is that it matches with the end of the month and quarter. Many investors, traders and portfolio managers are worrying on it as the Dow and the S&P 500 closed its sixth negative session of the last seven.

The uncertainty is the topic in the currency markets too, as investors prefer more hints in the Washington battle and, despite recent good economic data, about the possibility of further easing by the ECB. "In his recent speeches, Draghi has been teasing the markets with hints of further easing," comments the BabyPips.com FX-Men Team. "This is a bit surprising, considering the euro zone has recently shown notable improvements in consumer confidence and overall economic activity."

Answering this topic, BabyPips affirms that "the central bank is probably just trying to maximize their current easing programs by keeping a lid on longer-term rates." In this line, FXstreet.com's analyst Katarzyna Komorowska shares in her ECB and BoE previous that her sources "expect the European Central Bank to maintain monetary policy unchanged at the next meeting.”

In this framework, the EUR/USD's buying interest is losing momentum according to the Forecast Poll as experts expect more gains the next week. However, market players expect Euro to Dollar exchange rate to lose ground in the long term.

In the short term, FXstreet.com Chief Analyst comments that "the bearish case looks worse ahead of a new month start: next week, the ECB economic policy meeting and the US employment data, will surely provide more reasons to buy the pair than to sell it." As for technical levels, "failure to overcome 1.3570 and steady losses below mentioned 1.3460 should put the pair in downside corrective mode, eyeing then 1.3280 area, where the pair will finally fill the weekly opening gap from September 15th," concludes Bednarik.

The GBP/USD advanced on Friday and it closed above the 1.6100 area for first time since the Fed's non-taper day. It was the fourth week of gains in a row as the GBP/USD has won around 700 pips in a month and 1300 pips since July 6 when the pair posted its double bottom.

The USD/JPY lost all its Thursday’s gains on Friday as the pair declined from 99.00 to close at 98.25. The AUD/USD tested the 0.9300 area today after extending declines from September 19th highs at 0.9520.

Main headlines in the American session

August US Personal spending 0.3% vs 0.3% exp m/m

US: PCE rose 1.2% YoY in August

US: Reuters/Michigan Consumer Sentiment Index slides to 77.5 in September

Austria keeps the AAA rating, outlook stable

Dudley: Time between end of QE and first rate hike ‘could easily be a number of years’

CFTC Commitments of Traders: Traders dump bets on the dollar after the Fed

Wall Street declines on Friday and closes its first negative week in four

(Fxstreet)

Sunday, August 18, 2013

EUR/GBP showing weakness below 0.8550

EUR/GBP showing weakness below 0.8550

The EUR/GBP foreign exchange cross rate is last trading unchanged from previous weekly close Friday at 0.8527, off initial session highs at 0.8539 printed on Euro strength.

EUR/GBP targets an 0.85 break

With a completely blank economic agenda for the next London session ahead, “I like the sell-rally strategy in EUR/GBP now that we are below the previous pivot at .8600,” said FXWW founder Sean Lee. According to IFRMarkets analyst Andrew Spencer, the cross EUR/GBP “targets an 0.85 break.” Spencer points out that trend is “backed by string of positive UK data.”

EUR/GBP key technical levels

Immediate support to the downside for EUR/GBP lies at Wednesday's/Friday's lows 0.8527, followed by last Thursday's weekly lows at 0.8504, and July 03 lows at 0.8482. To the upside, closest resistance shows at recent session and weekly highs at 0.8540, followed by Friday's highs at 0.8554, and August 07/12 lows at 0.85

Sources

FXstreet (Barcelona)

Tuesday, July 30, 2013

New Zealand data due up at 0100GMT – business confidence and activity outlook

New Zealand data due up at 0100GMT – business confidence and activity outlook

ANZ Business Confidence for July: prior was 50.1 Also, ANZ Activity Outlook for July: prior was 45.0

ANZ Business Confidence for July: prior was 50.1 Also, ANZ Activity Outlook for July: prior was 45.0

Everything you need to know about oil prices right now

In an effort to keep it simple:

Crude rallied to $109 for some reason

That reason wasn’t global growth, which the IMF estimates at 2.2% this year

Supplies aren’t especially tight

I’m looking for crude to fall back to $99, which is the convergence of the 61.8% retracement of the June-July rally and the trendline/old high. The risk is a spike higher due to a hurricane.

Oil shorts are also another way to bet on US dollar strength.

SEC sues Spaniards over insider trading

SEC sues Spaniards over insider trading

By Kara Scannell in New York and Tobias Buck in Madrid

US securities regulators brought a new round of cases of alleged insider trading ahead of BHP Billiton’s failed bid for PotashCorp filing fraud charges against a former high-ranking executive at Banco Santander and a former Spanish judge.

The Securities and Exchange Commission sued Cedric Cañas Maillard, a Spanish citizen and former executive adviser to Santander’s chief executive, and his friend Julio Marín Ugedo, a former judge in Spain, for allegedly making a total of $1m in illegal profits after trading in advance of the planned 2010 takeover.

The lawsuit, filed in New York, is the latest case where the SEC has charged individuals based outside of the US for illegal stock trading. Earlier this year the SEC sued a Thai trader with buying securities of Smithfield Foods days before the US pork producer announced its takeover by China’s Shuanghui International. That case is ongoing.

The SEC has previously charged two traders with insider trading around the BHP takeover bid. The agency settled with one of them, a former Santander analyst, who agreed to pay $625,000, without admitting or denying wrongdoing. But a US judge threw out its case against the second man, a Spanish citizen, for lack of evidence. The SEC said its investigation is ongoing.

Santander declined to comment. The bank launched an internal investigation in 2010 and by January 2011 suspended Mr Cañas after allegations he had access to confidential information about the takeover bid, the SEC said. He is no longer with the bank. The SEC is seeking disgorgement of profits and penalty from both men, neither of them could be reached for comment.

According to the SEC, Mr Cañas allegedly learnt about the takeover attempt after BHP contacted Santander to line up financing for the acquisition in August 2010. He allegedly bought the equivalent of 30,000 shares of Potash stock by using contracts for difference, highly leveraged securities that trade outside of the US and which closely track securities listed on US exchanges, the SEC said.

If the price of the CFD rises, the buyer of the contract is paid the difference by the seller. By buying the contract, Mr Cañas was betting Potash shares would rise in value.

The SEC alleges Mr Cañas spoke, text messaged and emailed his childhood friend Mr Marin multiple times during the period of the takeover. Mr Marin “admitted that he discussed investing in Potash with Cañas in August 2010 before purchasing Potash stock,” the SEC alleged.

Mr Marin allegedly began buying shares of Potash the day after Santander’s executive committee approved $10.5bn in financing for BHP. He made $87,132 from his trades, the SEC said.

By Kara Scannell in New York and Tobias Buck in Madrid

US securities regulators brought a new round of cases of alleged insider trading ahead of BHP Billiton’s failed bid for PotashCorp filing fraud charges against a former high-ranking executive at Banco Santander and a former Spanish judge.

The Securities and Exchange Commission sued Cedric Cañas Maillard, a Spanish citizen and former executive adviser to Santander’s chief executive, and his friend Julio Marín Ugedo, a former judge in Spain, for allegedly making a total of $1m in illegal profits after trading in advance of the planned 2010 takeover.

The lawsuit, filed in New York, is the latest case where the SEC has charged individuals based outside of the US for illegal stock trading. Earlier this year the SEC sued a Thai trader with buying securities of Smithfield Foods days before the US pork producer announced its takeover by China’s Shuanghui International. That case is ongoing.

The SEC has previously charged two traders with insider trading around the BHP takeover bid. The agency settled with one of them, a former Santander analyst, who agreed to pay $625,000, without admitting or denying wrongdoing. But a US judge threw out its case against the second man, a Spanish citizen, for lack of evidence. The SEC said its investigation is ongoing.

Santander declined to comment. The bank launched an internal investigation in 2010 and by January 2011 suspended Mr Cañas after allegations he had access to confidential information about the takeover bid, the SEC said. He is no longer with the bank. The SEC is seeking disgorgement of profits and penalty from both men, neither of them could be reached for comment.

According to the SEC, Mr Cañas allegedly learnt about the takeover attempt after BHP contacted Santander to line up financing for the acquisition in August 2010. He allegedly bought the equivalent of 30,000 shares of Potash stock by using contracts for difference, highly leveraged securities that trade outside of the US and which closely track securities listed on US exchanges, the SEC said.

If the price of the CFD rises, the buyer of the contract is paid the difference by the seller. By buying the contract, Mr Cañas was betting Potash shares would rise in value.

The SEC alleges Mr Cañas spoke, text messaged and emailed his childhood friend Mr Marin multiple times during the period of the takeover. Mr Marin “admitted that he discussed investing in Potash with Cañas in August 2010 before purchasing Potash stock,” the SEC alleged.

Mr Marin allegedly began buying shares of Potash the day after Santander’s executive committee approved $10.5bn in financing for BHP. He made $87,132 from his trades, the SEC said.

Thursday, July 25, 2013

Flash: What does the EUR/USD have to offer? – UBS and Commerzbank

The euro is inching higher on Thursday, recovering ground lost after the USD bull run on Wednesday in response to US data above estimates. Ahead in the day, the German IFO indicator will be the main risk event in the bloc, as the EUR will look to find more solid ground to extend the recent rally.

Gareth Berry and Geoffrey Yu, Strategists at UBS, commented, “With the trending and momentum indicators pointing higher, focus is on further upside. Key resistance is at 1.3417. Support is at 1.3134 ahead of 1.3052”. It is worth noting that the bank holds a bullish outlook on the pair.

In addition, Karen Jones, Head of FICC Technical Analysis at Commerzbank, suggested the pair’s “current strength is expected to terminate ahead of the 78.6% Fibonacci retracement at 1.3275… The market should react back to 1.30 and loss of this zone is needed to re-target the 1.2755/40 recent low and April low”.

Credits:

FXstreet.com (Edinburgh) -

Gareth Berry and Geoffrey Yu, Strategists at UBS, commented, “With the trending and momentum indicators pointing higher, focus is on further upside. Key resistance is at 1.3417. Support is at 1.3134 ahead of 1.3052”. It is worth noting that the bank holds a bullish outlook on the pair.

In addition, Karen Jones, Head of FICC Technical Analysis at Commerzbank, suggested the pair’s “current strength is expected to terminate ahead of the 78.6% Fibonacci retracement at 1.3275… The market should react back to 1.30 and loss of this zone is needed to re-target the 1.2755/40 recent low and April low”.

Credits:

FXstreet.com (Edinburgh) -

Thursday, July 18, 2013

Todays Top Financial News

TGIF and all that…..

There’s little to excite this morning on the data front….

(All times GMT)

0430 Japanese June All industry activity index, exp 1.3% m/m

0500 Japanese May leading economic index, last 107.7, coincident index last 105.1

0600 German June PPI, exp flat m/m, 0.6% y/y

0800 Italian May Industrial sales last 0.6% m/m, -7.2% y/y

0800 Italian May Industrial

There’s little to excite this morning on the data front….

(All times GMT)

0430 Japanese June All industry activity index, exp 1.3% m/m

0500 Japanese May leading economic index, last 107.7, coincident index last 105.1

0600 German June PPI, exp flat m/m, 0.6% y/y

0800 Italian May Industrial sales last 0.6% m/m, -7.2% y/y

0800 Italian May Industrial

Monday, July 8, 2013

Breaking News: Draghi says higher rates aren’t Warranted Presently

Draghi says higher rates aren’t warranted currently And;

- Hard to disagree with BIS that low rates for long pose risks

- ECB shares principle of objective of FTT

- FTT has many undesired consequences for monetary policy

EUR/USD on the up as Draghi puts “low rates” and “risk” in one sentence.

How “forward” is forward guidance then and when does the risk enter?

EUR/USD clawing back from Fridays losses. Now at 1.2870 from 1.2842

USD/JPY to Challenge Topside.

FXstreet.com (London) - USD/JPY is holding up above 101.00, offering a key base for the week ahead.

USD/JPY has reached a high in this morning’s trade of 101.38. Since then, the pair have edged away towards the handle before finding support and taking a walk back to the 101.20’s. The market has been more stable after least weeks, turbulence. Ahead of BoJ, Fed minutes and second tier US data releases coming up later on in the week.

USD/JPY to challenge topside

Karen Jones, Chief Analyst at Commerzbank, said USD/JPY is eroding the top of the 101.17 cloud, and also the previous uptrend, which now acts as resistance at 101.53. This suggests to her that there is unfinished business on the topside and suggest that the 103.74 May high will be challenged.

GBP/USD hanging around 1.4900

The GBP/USD moved marginally higher during the European session, as markets started the week in a quiet tone.

GBP/USD struggling around 1.4900

GBP/USD managed to hold above the 1.4855 support zone and briefly rose above the 1.4900 mark to hit a daily high of 1.4912. However, the pound lacked momentum to extend the recovery and eased back to the psychological level.

GBP/USD levels

At time of writing, GBP/USD is trading at the 1.4890/1.4900 zone, still up 0.1% on the day. In terms of technical levels, next resistances are seen at 1.4912 (daily high) and 1.5000 (psychological level) while on the downside, supports could be found at 1.4855 (Jul 5 low) and 1.4832 (Mar 12 low).

GBP/USD struggling around 1.4900

GBP/USD managed to hold above the 1.4855 support zone and briefly rose above the 1.4900 mark to hit a daily high of 1.4912. However, the pound lacked momentum to extend the recovery and eased back to the psychological level.

GBP/USD levels

At time of writing, GBP/USD is trading at the 1.4890/1.4900 zone, still up 0.1% on the day. In terms of technical levels, next resistances are seen at 1.4912 (daily high) and 1.5000 (psychological level) while on the downside, supports could be found at 1.4855 (Jul 5 low) and 1.4832 (Mar 12 low).

Monday, June 24, 2013

How To Make Money From FOREX Trading

Back when I first started trading, over two decades ago, we did not have access to free real-time price charting platforms, low commissions and low per-point markets. In addition, we could only trade during the day as there was no such thing as extended-hour trading.

Today, we have it all!

The FOREX market is a virtual 24-hour market. Here in the US, it runs from Sunday evening to Friday evening. So except for the weekend, you can trade at anytime from anywhere.

FOREX online accounts are easy to find and open. Most provide free electronic price data and charts in real-time. Some offer the option of reducing the pip size so that even very small accounts can trade without big risk exposure.

The key to making money trading FOREX is to first learn all you can about how the FOREX market works. For that you only need to do a search or read the training materials provided by most brokerages.

Next, setup your account and trade using only the demo account. You want to get used to the process of trading, and you want to make sure you familiar with your platform on how to enter and exit manually, as well as setting up entry and exit stops so that you can step away from the platform and know your trade is protected.

Next you need to learn an effective method for determining where to enter and exit. In my opinion, the first method you should learn is how to determine the trend.

FOREX markets tend to trend often. This stands out as different then most other markets. Once you lock into a trend, you can ride it for all its worth.

So how do you determine trends? One method is taught by W. D. Gann and is called the Trend Line Indicator. I recommend that you search on that phrase and learn this method of identifying the trend pattern.

Next, once you have learned about trends and how to use the Trend Line Indicator, you need to learn about support and resistance. In order to make money trading FOREX, the key is to get into a trend at the end of a trend correction.

A trend correction is a move that is counter to the trend. If the trend is bullish, it is making higher swing bottoms. Each of those swing bottoms happen to be the end of a correction against the trend. By entering when those higher swing bottoms are formed, you are entering at the lowest risk price level and giving yourself an opportunity for greater profits.

In a bear trend, the end of corrections happen to be where the lower swing tops form.

What you need to learn is how to determine when a correction is likely ending. One way is to calculate support and resistance. To do that, you simply can use Gann or Fibonacci ratios of the trend move prior to the correction.

For example, if the market is bullish, when a correction starts and prices are moving down against the trend, take the distance of the prior bottom to prior top in points and multiply it by your ratios. For Fibonacci ratios, look for prices to correct about 38.2%, 50% or 61.8% of the prior move up. If you find the correction holding at any of these levels and start to turn up again, you may have found the end of the correction.

For Gann ratios, they are similar. You divide the prior range (in a bull market is from prior low to prior high) by 3, 4 and 8. Dividing by 3 gives you levels in thirds, such as 33.3%, 66.6%. Dividing by 4 gives you quarters, such as 25%, 50% and 75%. And by 8 gives you eighths, such as 12.5%, 25%, 37.5%, 50%, 62.5%, 75% and 87.5%.

There is much written about support and resistance. Learn as many methods as possible about this subject if you really want to make money trading FOREX.

To increase your odds of finding the end of corrections to enter trades from, you should include a TIME based method for timing. While prices usually will make bottom or top at some support or resistance level, sometimes it stops at one support level only to break through the next day or two to the next level, and so forth. This can be frustrating at times.

Using a TIME based method along with your price based method can help you narrow down where and when the market is likely to turn again. For this purpose, I use FDates (turn dates) provided through my membership. However, if you are wanting to learn to calculate these yourselves, I highly recommend that you study the works of W. D. Gann and to also learn Fibonacci methods. These methods will help you move toward a more time/price way of timing that I have found to be the best way to make money trading FOREX today!

What to become a profitable trader? Want to find more trades with

less risk and greater profit potential? Become the trader you know you

can become. Visit http://www.AmazingAccuracy.com and get started right away!

Forex flash: GBP/USD failing at the gap

GBP/USD failing at the gap

FXstreet.com (London) - GBP/USD indeed climbed to reach the bridge but couldn’t cross it through the offers.GBP/USD was on path to move through the gap on the hourly charts but failed at resistance with bears in the NY session denying it at 1.5435. At the time of writing, the pair are offered and oscillating around the figure.

GBP/USD lower on upside momentum

With the pair starting the week at these levels, and failing to break above the gap, requiring closes there, it appears that there is going to be a good case for the bearish trend to resume further into the week, with momentum indicators and MA’s in the red, including linear regression indicators fortifying the bears apatite. Key support is sited as low as 1.5165 while a move to the upside and closes above 1.5470 remaining above pivot point 1.5430/40 could produce a sideways channel ahead of 1.5520 resistance.

Tuesday, June 11, 2013

AUD/USD: Wait and see if local sellers turn up again

Slovenia to rescue its banking sector

FXstreet.com (Barcelona) - Slovenia is about to inject over €900 million to rescue its debt-laden banking system.

FXstreet.com (Barcelona) - Slovenia is about to inject over €900 million to rescue its debt-laden banking system.According to source familiar with the talks, the urgent measures to save the banks may be planned for late this month so that the country can temporarily avoid to be bailed-out by international lenders, which include the EU, ECB and IMF.

Prime Minister Alenka Bratusek was direct on her official statement, telling the Czech daily Hospodarske noviny that: "We will carry out the capitalisation according to the central bank's estimate by the end of June."

In view of Slovenian PM, "Our goal is to transfer the first package of toxic loans to the bad bank by the end of June."

At this point, the country's largest bank, Nova Ljubljanska Banka (NLB), and the second largest, NKBM, approved earlier on the week to take up 500 and 400 million euros respectively to be recapitalized.

In total, the government is expected to make a disbursement of 1.3 billion euros to restructure its bank's balance sheets.

The bad augurs in the country are mounting, with the latest projections pointing at Slovenia's deficit around 8%/GDP, almost 3x above the agreed targets set by the EU.

Yen roars ahead on astronomic volatility

FXstreet.com (Barcelona) - After having had a roughly 30% upmove in the USD/JPY driven by the radical shift in monetary policies brought forward by 'Abenomics', sellers of the Yen in recent weeks continue to get burn out, with today's fall, the sharpest 1-day fall in over 3 years, exemplifying that the tide is turning. Will it last?

FXstreet.com (Barcelona) - After having had a roughly 30% upmove in the USD/JPY driven by the radical shift in monetary policies brought forward by 'Abenomics', sellers of the Yen in recent weeks continue to get burn out, with today's fall, the sharpest 1-day fall in over 3 years, exemplifying that the tide is turning. Will it last?With the ongoing upward pressure on the Yen, has come an enormous volatility, which, as described by Adam Button at Forexlive, it might have a lot to do with correlations-based algorithm programs either breaking down, no longer activated as money is starting to get lost or going haywire. As Button says, "All three of those options sap liquidity and drive volatility", adding that "In addition, the wild moves in markets have made traders especially jumpy."

Today's 300+ slide from highs at 99.26 down to 95.60 were prompted by the disappointment that represented the stand-off in monetary policies by the Bank of Japan during yesterday's call. The central bank stood pat failing to change the maturities of fixed rate operations something that was somehow expected to ease volatility in the JGB.

Thursday, June 6, 2013

EUR/USD: traded as high as 1.3305

FXstreet.com (Buenos Aires) – The wild dollar selloff has lead to a test of the 1.3305 level in the EUR/USD, levels not seen since late February this year. Despite pulling back some at the time being, the pair holds into its gains, having added nearly 2 cents today. An ECB offering no economic policy change along with a more confident outlook, has helped the pair earlier, but is yen strong advance what triggered dollar selloff across the board and therefore, such gains in the EUR/USD.

At current levels, the pair maintains a strongly positive bias, with immediate support at 1.3241, May 1st daily high, followed by the 1.3190/1.3200 area that contained price advance several times over the last two months. With New York heading for lunch, and London closing down, market will likely child down a bit now, and consolidate ahead of tomorrow’s US NFP figures.

Tuesday, June 4, 2013

New version of MetaTrader 4 (build 500) released

New version of MetaTrader 4 (build 500) released

- Managing trading levels from chart using drag'n'drop

- Access of MQL4 applications to Code Base from the terminal using drag'n'drop

- Company's web site tab in the client terminal

- Added ability to drag and drop trading levels of orders and positions. To set SL and TP levels on position, just drag a trading level of an order upwards (TP for "BUY" positions) or downwards (SL for "SELL" positions). When One Click Trading mode is enabled, dragging trading levels of orders and positions results in an immediate modification of the appropriate order or stop level without showing a trading dialog.

- download yours Here

Monday, June 3, 2013

Activate coupon and get $30 for trading in Forex.

Hello,

As we all know, “One who has many friends never needs a full purse”. Nowadays, it means that your income can depend directly on the number of your friends.

LiteForex group of companies is a reliable and stable broker on the Forex market. Our cooperation has already made me lots of profit. Lately, I’ve received 20 unique promotion coupons from LiteForex that I can now distribute among my friends and acquaintances who are interested in the online trading. I’d like to offer you one of those coupons, with the denomination of $30: 0VHVNQTRFYCVYUC5. http://goo.gl/tnL3c

All you need to do to receive the opportunity to use this extra $30 bonus is reLiteForex group of companies and activate the coupon.

Registration link: http://www.liteforex.com/coupon_code/?coupon=0VHVNQTRFYCVYUC5

Good luck!

gister an account with

As we all know, “One who has many friends never needs a full purse”. Nowadays, it means that your income can depend directly on the number of your friends.

LiteForex group of companies is a reliable and stable broker on the Forex market. Our cooperation has already made me lots of profit. Lately, I’ve received 20 unique promotion coupons from LiteForex that I can now distribute among my friends and acquaintances who are interested in the online trading. I’d like to offer you one of those coupons, with the denomination of $30: 0VHVNQTRFYCVYUC5. http://goo.gl/tnL3c

All you need to do to receive the opportunity to use this extra $30 bonus is reLiteForex group of companies and activate the coupon.

Registration link: http://www.liteforex.com/coupon_code/?coupon=0VHVNQTRFYCVYUC5

Good luck!

gister an account with

Sunday, June 2, 2013

Major Currency Pair Analysis for the Week

Major Currency Pair Analysis for the Week

The US dollar had mixed results last week against the other major currencies in the foreign exchange trading markets. The greenback continued its ascent against the commodity currencies (Australian dollar, New Zealand dollar, Canadian dollar) while falling against the European currencies (euro, British pound sterling, Swiss franc) and also declining against the Japanese yen for a second straight week.

This week’s fundamental calendar is full of important economic events with a major focus on Friday’s US nonfarm payrolls report while there is also three interest rate decisions (Australia, euro zone, United Kingdom) for the markets to digest. See the currency pair commentary & major economic highlights below.

Major Currency Pair Commentary:

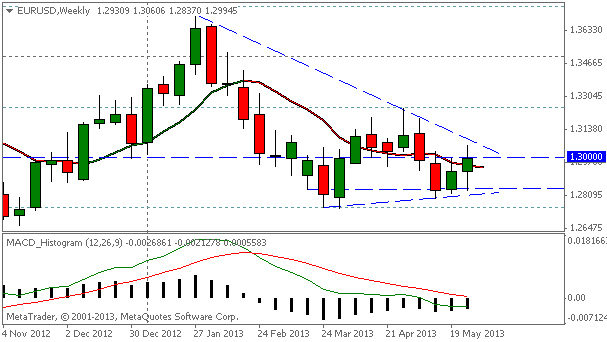

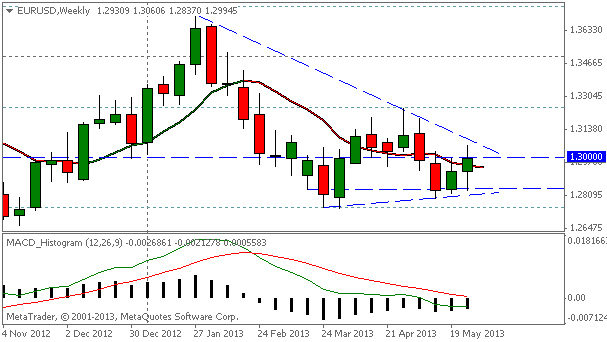

EUR/USD — The euro made gains against the dollar last week but failed in its bid to surpass the major 1.30 level. This week will be all about overcoming this major level and whether this pair can build some upward momentum. Levels to watch this week are the previously mentioned 1.30 major and on the downside, the 1.2900 and also the 1.2850 level for weekly support.

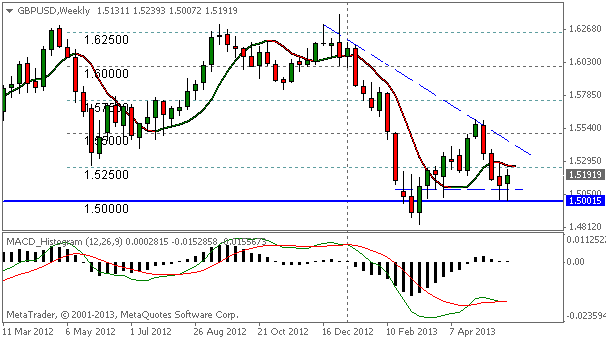

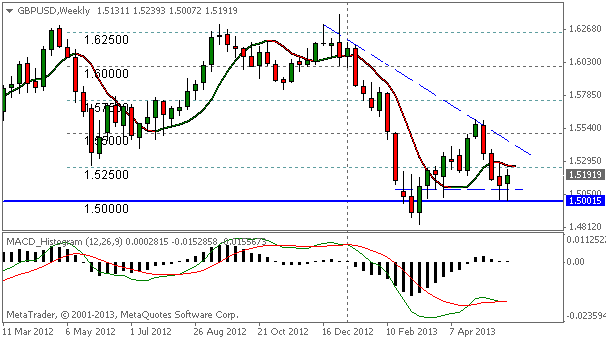

GBP/USD — The pound sterling fought back last week from three straight weekly declines to gain against the US dollar as the pair bounced off the major psychological 1.50 level. Levels to watch this week are at 1.5250 level which has provided previous support and resistance. A close above this level would indicate bullish momentum going forward. On the downside, support comes in around the 1.5100 — 1.5090 area and then the major 1.50 support level which has provided price bounces for the past two weeks.

USD/JPY — The dollar has fallen against the Japanese yen for two straight weeks and looks to test the major support and resistance area of 100.00. This is a major test for this currency pair and will likely determine the short-term direction as well as whether the 100 level will act as future support or future resistance. A close below 100 could bring a correction to the 97.50 target area.

USD/CHF — The Swiss franc has gained against the dollar for two straight weeks as this currency pair has run into selling resistance above the 0.9750 area. This currency pair trades currently near the 0.9550 level which had acted as previous support and resistance. Levels to watch for this week are 0.9550 and 0.9500 while a close below 0.9500 could open up further decline to the 0.9250 area. Upside momentum will likely see resistance at the 0.9650 level and into the 0.9700 — 0.9750 area.

The US dollar had mixed results last week against the other major currencies in the foreign exchange trading markets. The greenback continued its ascent against the commodity currencies (Australian dollar, New Zealand dollar, Canadian dollar) while falling against the European currencies (euro, British pound sterling, Swiss franc) and also declining against the Japanese yen for a second straight week.

This week’s fundamental calendar is full of important economic events with a major focus on Friday’s US nonfarm payrolls report while there is also three interest rate decisions (Australia, euro zone, United Kingdom) for the markets to digest. See the currency pair commentary & major economic highlights below.

Major Currency Pair Commentary:

EUR/USD — The euro made gains against the dollar last week but failed in its bid to surpass the major 1.30 level. This week will be all about overcoming this major level and whether this pair can build some upward momentum. Levels to watch this week are the previously mentioned 1.30 major and on the downside, the 1.2900 and also the 1.2850 level for weekly support.

GBP/USD — The pound sterling fought back last week from three straight weekly declines to gain against the US dollar as the pair bounced off the major psychological 1.50 level. Levels to watch this week are at 1.5250 level which has provided previous support and resistance. A close above this level would indicate bullish momentum going forward. On the downside, support comes in around the 1.5100 — 1.5090 area and then the major 1.50 support level which has provided price bounces for the past two weeks.

USD/JPY — The dollar has fallen against the Japanese yen for two straight weeks and looks to test the major support and resistance area of 100.00. This is a major test for this currency pair and will likely determine the short-term direction as well as whether the 100 level will act as future support or future resistance. A close below 100 could bring a correction to the 97.50 target area.

USD/CHF — The Swiss franc has gained against the dollar for two straight weeks as this currency pair has run into selling resistance above the 0.9750 area. This currency pair trades currently near the 0.9550 level which had acted as previous support and resistance. Levels to watch for this week are 0.9550 and 0.9500 while a close below 0.9500 could open up further decline to the 0.9250 area. Upside momentum will likely see resistance at the 0.9650 level and into the 0.9700 — 0.9750 area.

Thursday, May 30, 2013

Which is More Overbought: US Dollar or S&P 500?

A market will rise until it doesn’t. Both

fundamental and technical debate has raged over the months and years

about the legitimacy of risk appetite’s rise from the ashes back in

2008/2009. That conversation only grows more intense as record highs for

benchmarks like the S&P 500 scale record highs while market yields

scrape record lows, growth has proven inconsistent and market

participation holds to anemic levels. The external element that fills this wildly divergent gap between price and potential: stimulus.

While the risk-sensitive (stimulus-dependent)

capital market’s climb is one fundamental abnormality that is now a

common topic of conversation, a relatively newer stimulus-generated

disparity has gained far more interest as of last – the positive correlation between risk appetite and the US dollar’s performance.

Traditionally, the favored safe haven for the FX world, we expect the

greenback to fall while even an ill-deserved risk run is underway.

With the introduction of speculation surrounding Fed ‘tapering’, we have likely lit the fuse for a reversal from one of these two assets. Why? Either the Fed starts to temper its support and risk built on a constant escalation of outside support falls apart will collapse.

Otherwise, the dollar’s recent surge to near three-year highs on

expectations of an immediate QE3 taper will prove overdone. So, which of

these measures of market appetite have over-run their reasonable

bounds? (As market conditions change, so should your strategy)

The lynchpin is sentiment itself. If the low-volume,

high-reach speculative build up holds steady (it may not even have to

post progress); the US dollar will take a spill. Alternatively, if a

shock of fear shoots through the market, the greenback will turn from

‘overbought’ to bull trend immediately while the record high S&P 500

will dive over a cliff.

While wait for the fundamental spark to settle this

debate, here are measures that show just how overbought the dollar and

S&P 500 are.

The US Dollar (Dow Jones FXCM Dollar Index)

Charting Created by John Kicklighter usingMarketscope 2.0

One of the more recognizable measures of overbought markets is the simple RSI indicator. Above, you see that the standard 14-day RSI has crossed back below 70, so it has crossed down from its ‘extreme’ reading.

Next we have a different type of read. This uses the

100-day moving average to measure momentum. The green reflects how far

above or below USDollar has moved beyond its average. The further it

stretches, the greater the potential that the market is overdone.

Recently, we have started to pull back from a 450 point spread – the

peak back at the beginning of the year and July 2010.

EUR/AUD off fresh 1.5-year highs below 1.35

FXstreet.com (Barcelona) - EUR/AUD is last at 1.3491, off yesterday's

fresh 1.5-year highs at 1.3541, up +0.66% for the week so far, +6.27%

year to date, and +8.25% in last 6 months. As IFR Markets analyst Andrew

Spencer points out, it has been already 8 weeks of higher lows in the

cross.

“EUR/AUD continues to march higher and barring any unexpected negative news from the EZ, my technical target at 1.38 looks very achievable,” said FXWW founder Sean Lee, reporting stop loss orders above the 0.9720 level in the AUD/USD. Private sector credit data in Australia came in line with expectations at +0.3%, slightly above last 3 months, leaving Aussie muted on the news.

Immediate resistance to the upside for EUR/AUD shows at recent session highs 1.3524, followed by yesterday's fresh 1.5-year highs at 1.3542, and Sept 2010 lows at 1.3629. To the downside, closest support lies at current levels as Wednesday's highs 1.3475, followed by Monday's highs at 1.3450, and Friday's highs at 1.3433.

“EUR/AUD continues to march higher and barring any unexpected negative news from the EZ, my technical target at 1.38 looks very achievable,” said FXWW founder Sean Lee, reporting stop loss orders above the 0.9720 level in the AUD/USD. Private sector credit data in Australia came in line with expectations at +0.3%, slightly above last 3 months, leaving Aussie muted on the news.

Immediate resistance to the upside for EUR/AUD shows at recent session highs 1.3524, followed by yesterday's fresh 1.5-year highs at 1.3542, and Sept 2010 lows at 1.3629. To the downside, closest support lies at current levels as Wednesday's highs 1.3475, followed by Monday's highs at 1.3450, and Friday's highs at 1.3433.

How to Trade with Bollinger Bands in Forex Trading.

Bollinger bands are used to measure the volatility in the price action. They work in almost all market and with any type of security. Volatility is measured with the use of standard deviations in statistics. So, what Bollinger Bands do is to plot the standard deviation above and below the simple moving average. A simple moving average is used to smooth out the price action.

Bollinger bands are used to measure the volatility in the price action. They work in almost all market and with any type of security. Volatility is measured with the use of standard deviations in statistics. So, what Bollinger Bands do is to plot the standard deviation above and below the simple moving average. A simple moving average is used to smooth out the price action.By plotting the standard deviations above and below the moving average you infact create an envelope that show how much volatile the market is. Widening of the bands show that the market is becoming more volatile while narrowing of the bands show that the market volatility is decreasing. BBs are widely used to determine the overbought/oversold condition in the market as well as confirm divergence between the price action and the indicator. Keep these tips in mind when trading with Bollinger Bands (BBs):

1. Bollinger Bands are plotted above or below the simple moving average.

2. The default settings for the Bollinger Bands simple moving average is 20 periods.

3. The default settings for the two bands is two standard deviations above or below the simple moving average. These bands keep on increasing and decreasing in width as the market volatility increases or decreases.

4. Now, this very important if you change the number of periods of the simple moving average, you should change the standard deviation of the bands as well. For example if you increase the period to 50, increase the standard deviation to two and a half and if you decrease the period to 10, decrease the standard deviation to one and a half. Periods less than 10 do not seem to work well. 20 or 21 period is the optimal setting.

5. You can use any timeframe for using Bollinger Bands that can vary from 5 minutes to daily to weekly or monthly.

6. Rapid price movement tends to take place after the bands tighten.

7. Prices moving above the upper BB is a sign of strength and prices moving below the lower BB is a sign of weakness.

8. When prices move outside the band, tend continuation is a good assumption.

9. A move outside the band followed by a sharp retracement is a sign of price exhaustion.

10. Always use another technical indicator when trading with BBs. One technical indicator that works very well with BBs is the RSI.

By Expert Author Ahmad A Hassam

Labels:

bbc,

bloomberg,

bollingerbands,

cnbc,

cnn,

dailyfx,

forex,

forexfactory,

forextrading,

forextutorial,

fxstreet,

money,

news

Tuesday, May 28, 2013

How to Set Up a Forex Trading Business?

How to Set Up a Forex Trading Business

Trading forex--the foreign exchange market--can be a lucrative business that gives you the time and financial freedom to do as you want and live where you please. However, as anybody who has ever traded can tell you, it is not an easy business to become successful at. But if you are willing to put the time and effort in, there are a few tips on how to set up a forex trading business that may save you some headaches along the way.

- Decide on a business model.

- Find a forex trading system that suits your needs and that wins consistently.

- Find a broker and test it out to see if it suits you

- Choose a business type

- Build a track record

- Build a website

- Market your site

Monday, May 27, 2013

US Dollar Index Forecast

US Dollar Index Forecast May 28, 2013, Technical Analysis

Depressed Aussie dollar could weigh heavily on kangaroo bonds

* Kangaroo issuance at risk as A$ slides

* Bond underwriters already coping with soaring swap costs

* Key hurdle in assessing counterparty risk

By Cecile Lefort

SYDNEY, May 28 (Reuters) - Bond issuance by overseas borrowers in Australia could face strong headwinds as the once-red hot Aussie dollar suffers a violent turnaround, adding to the soaring costs of capital adequacy compliance for bond underwriters.

Kangaroo bonds, Australian dollar-denominated debt issued by foreign borrowers, was about one third of the A$90 billion ($86.75 billion) of non-government bond debt sold locally last year - a useful fee revenue stream for intermediary banks.

But with the Aussie dollar slumping 7 percent this month and hedge funds having recently declared "shorting" the Aussie dollar their favoured strategy, analysts forecast more losses.

"If the Aussie dollar is about to take a nosedive, kangaroo bond issuance may be about to go the same way, especially if current international holders now decide to take profits and reduce their currency exposure," said Phil Bayley, an academic and debt capital market consultant at ADCM.

The Aussie dollar last fetched $0.9621, a level near its weakest in a year.

So far this year, A$13 billion of kangaroo bonds has been sold, down from A$20 billion in 2011 when the Aussie dollar was near a lifetime high above $1.09, according to ThomsonReuters data.

A sharp drop in kangaroo bond sales, however, would rub salt into the wound for many fixed income securities firms struggling with the soaring costs they must incur to protect bank capital under the Basel III rules set by the Bank for International Settlements.

"It's more expensive now than it's ever been to exchange currencies around cross currency swaps because of bank regulatory costs and how people value the risk of their counterparty," said Steve Lambert, executive general manager of debt markets at National Australia Bank.

RBC Capital Markets and Commonwealth Bank of Australia vanished from this year's top 10 ranking of kangaroo bonds, a debt deal denominated in Australian dollars and issued by offshore borrowers, often multilateral institutions such as the Asian Development Bank.

In the past six years, RBC topped the table three times, while CBA came third in 2008 and 2009, ThomsonReuters data shows.

Swaps are an important financial tool as they allow two parties to exchange future cash flows on debt or currencies to hedge risk or make a profit.

A key hurdle faced by bond underwriters is a costly and massive revamping of the banks' internal assessment of how much collateral, usually cash, is needed to back every single uncleared swap trade.

Since a global investment bank typically holds millions of swap contracts on any given day, the equation involves extremely complex calculations. They include credit value adjustments (CVA) on a mark-to-market basis and modelling assumptions which can lead to notably different pricing outcomes.

* Bond underwriters already coping with soaring swap costs

* Key hurdle in assessing counterparty risk

By Cecile Lefort

SYDNEY, May 28 (Reuters) - Bond issuance by overseas borrowers in Australia could face strong headwinds as the once-red hot Aussie dollar suffers a violent turnaround, adding to the soaring costs of capital adequacy compliance for bond underwriters.

Kangaroo bonds, Australian dollar-denominated debt issued by foreign borrowers, was about one third of the A$90 billion ($86.75 billion) of non-government bond debt sold locally last year - a useful fee revenue stream for intermediary banks.

But with the Aussie dollar slumping 7 percent this month and hedge funds having recently declared "shorting" the Aussie dollar their favoured strategy, analysts forecast more losses.

"If the Aussie dollar is about to take a nosedive, kangaroo bond issuance may be about to go the same way, especially if current international holders now decide to take profits and reduce their currency exposure," said Phil Bayley, an academic and debt capital market consultant at ADCM.

The Aussie dollar last fetched $0.9621, a level near its weakest in a year.

So far this year, A$13 billion of kangaroo bonds has been sold, down from A$20 billion in 2011 when the Aussie dollar was near a lifetime high above $1.09, according to ThomsonReuters data.

A sharp drop in kangaroo bond sales, however, would rub salt into the wound for many fixed income securities firms struggling with the soaring costs they must incur to protect bank capital under the Basel III rules set by the Bank for International Settlements.

"It's more expensive now than it's ever been to exchange currencies around cross currency swaps because of bank regulatory costs and how people value the risk of their counterparty," said Steve Lambert, executive general manager of debt markets at National Australia Bank.

RBC Capital Markets and Commonwealth Bank of Australia vanished from this year's top 10 ranking of kangaroo bonds, a debt deal denominated in Australian dollars and issued by offshore borrowers, often multilateral institutions such as the Asian Development Bank.

In the past six years, RBC topped the table three times, while CBA came third in 2008 and 2009, ThomsonReuters data shows.

Swaps are an important financial tool as they allow two parties to exchange future cash flows on debt or currencies to hedge risk or make a profit.

A key hurdle faced by bond underwriters is a costly and massive revamping of the banks' internal assessment of how much collateral, usually cash, is needed to back every single uncleared swap trade.

Since a global investment bank typically holds millions of swap contracts on any given day, the equation involves extremely complex calculations. They include credit value adjustments (CVA) on a mark-to-market basis and modelling assumptions which can lead to notably different pricing outcomes.

One banker reckoned the gap could now be up to 20 basis

points for the same contract, against one or two bps before.

($1 = 1.0375 Australian dollars)

(Additional reporting by Umesh Desai in Hong Kong; Editing by

Eric Meijer)

Subscribe to:

Posts (Atom)

Disclaimer:- The information on online Forex trading presented on this website should not be regarded as Forex or currency trading advice. Currency

trading and FX trading is a highly speculative way of making money and should not only be done with the information on this website only. Accordingly, we

make no warranties or guarantees with respect to the correctness or validity of its content. Forex traders, swing traders and day traders making use of the

online currency trading information presented do so at their own risk. The Forex market information provided herein does not take into account their Forex

investing objectives, financial situation or needs of any particular person. This site is not intended to by used as the only source of currency trading

information, Forex education or work from home opportunity. It is important and assumed that traders use sound trading principles when using the online

Forex trading information on this currency trading site. Please use demo accounts where there is no investment required to test Forex Strategies. This

includes trading common sense, sound money and risk management and full personal ownership of any trading decisions. This disclaimer applies to all

services, including PayPal, Google, Click Here, Yahoo, Ebay, YouTube and Clickbank promotions placed on the website. Investors should obtain individual

financial advice based on their own particular circumstances before making any foreign currency investment decision.

trading and FX trading is a highly speculative way of making money and should not only be done with the information on this website only. Accordingly, we

make no warranties or guarantees with respect to the correctness or validity of its content. Forex traders, swing traders and day traders making use of the

online currency trading information presented do so at their own risk. The Forex market information provided herein does not take into account their Forex

investing objectives, financial situation or needs of any particular person. This site is not intended to by used as the only source of currency trading

information, Forex education or work from home opportunity. It is important and assumed that traders use sound trading principles when using the online

Forex trading information on this currency trading site. Please use demo accounts where there is no investment required to test Forex Strategies. This

includes trading common sense, sound money and risk management and full personal ownership of any trading decisions. This disclaimer applies to all

services, including PayPal, Google, Click Here, Yahoo, Ebay, YouTube and Clickbank promotions placed on the website. Investors should obtain individual

financial advice based on their own particular circumstances before making any foreign currency investment decision.

Ethereal theme. Theme images by Petrovich9. Powered by Blogger.